- Impulse bidding can be a real issue

- Auction properties may have an unfavourable reputation

- It is not easy to discern the defects

- Consider the legal problems

Now with the looming recession and a pandemic that doesn’t seem to cease, it is safe to say that the global economy is at its worst. And when things get bad, it also comes as no surprise that property will go up for auction due to many reasons, the inability to pay loan mortgage being one of them.

It is a sad moment for most of us, but definitely not for my Uncle Marney who has a deep pocket. He sees this as a big shopping opportunity. As the rich used to say, “we buy when everyone else is selling, and we sell when everyone else is buying.”

As we all know, properties on auction are usually selling at way below the market rate. It is common knowledge that an astute buyer can make a killing with such purchases.

But the truth is not so simple, as auction properties carry many hidden dangers. I’m not an expert on this topic, so I’m going to let my affluent Uncle Marney explain this.

1/ You are your own worst enemy

Have you ever been to a buffet, and there is this lavish spread of food for the taking? That is what you will feel when gazing at all these cheap properties for grab. But hold up!

Properties selling at a considerable discount may be in a bad location, have an outdated design or harbour legal problems that are not apparent until after you purchase it. But greed has a way to cloud our judgement, making us jump right into the transaction.

Also, you may be fighting against another bidder for the house in question, and the bidding war is slowly raising the price above the average transacted rate.

The funny thing is we humans don’t want to lose, so this instinct will drive us into a reckless fight that will end up with us paying a much higher price than was necessary.

Uncle Marney says, “the art is to know when to stay in the bid, and when to leave. But of course, that is easier said than done.”

2/ Spooky homes

Are you into ghost stories? Or horror movies? Watching a scary show with Uncle Marney at my side is a terrible thing indeed. He would scream whenever the monster showed up, making the show more frightening than it truly is.

But you know what’s scarier than a two-hour horror movie? Living 24/7 in a haunted property. The idyllic facade of an auction home may hide tragedies, such as a murder case.

Depending on your beliefs, you might not want to live in a home that harbours such a reputation. Superstitious buyers and would-be tenants deem such homes as bad luck and they won’t touch it with a ten-foot pole.

This attitude is bound to affect the economic value of your property, either for resale purposes or for rental generation. Uncle Marney said that you can busy body with the neighbours surrounding the auction property to know more about its history. The auctioneer may know about it, but they might be unwilling to divulge these secrets.

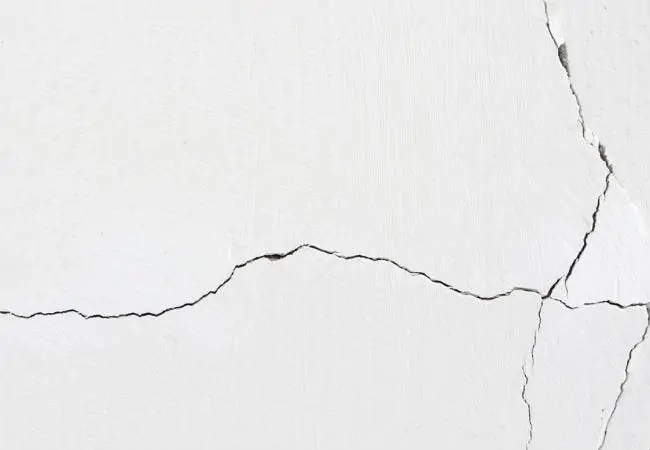

3/ Invisible costs

Uncle Marney said, “A frenemy is more dangerous than an enemy. Because you don’t know a frenemy is your enemy until it is too late.” I think what Uncle Marney is trying to say is that those auction properties could have hidden defects. You really need to interpret the things he says.

Oh, Uncle Marney, you need to get your head checked once in a while.

Unlike properties in the primary and secondary market, you are usually not allowed to enter an auction property, although you can still check it from the outside.

This can be a problem as defects are only obvious from the inside, making it hard for bidders to appraise its worth. According to Uncle Marney, you can inquire if the property has been vacant and for how long. Properties left empty for many years might require a major overhaul.

The piping and electrical circuitry might be defective, not considering leakages and other related matters. All these possible defects will increase the amount of money you need to invest in bringing the property back into shape. With auction properties, a certain degree of luck is required.

4/ Legal problems

What happens when you successfully bought a home from the auction, only to find out that it is still being inhabited by its previous owner, a man with a wife and one kid? Oh great, your property is a three-in-one package now; buy one free three humans. That is a bargain.

But wait! You tell them to leave, and all they do is slam the door in your face and go about minding their own business.

Then there are those troublesome people who try to make a final statement by destroying household items or making your property inhabitable before packing their bags.

Seasoned players in the auction market know to stay away from properties that are still occupied unless the discounts are good enough to warrant the hassles required to remove them.

But that is not all! Uncle Marney said he once had a Korean friend named Ban Kyup Tsy who didn’t perform his due diligence when buying an auction property. According to the story, Ban Kyup Tsy was shocked to find out the hefty bill incurred by the previous owner.

This invisible cost becomes apparent when the maintenance fees and other accumulated charges turn up on your grand total over many years. Before going for the auction, it is prudent to visit the management office with a copy of the Proclamation of Sales to check up on the outstanding bills.

This could include utility bills like water and electricity if they are channelled through the management office. The foreknowledge allows you a better estimate of the actual price of the property and hence, the total amount of money you are willing to commit for the bid.

Do your homework

Those who assume buying auction property is a quick road to riches will be in for a rude awakening. It is not for the amateur property investor and those who do not perform their due diligence will find themselves in a lot of trouble.

Great reward does not come easily or often, and when something feels like it is too good to be true, maybe it is! Bottom line, be like Uncle Marney and not like Ban Kyup Tsy.

Looking for more related article? Check them out here:

The Secrets To Getting Your Loan Approved