This article is written by Chai Yee Hoong, and first appeared in City & Country, The Edge Malaysia Weekly, on March 27, 2023 – April 02, 2023.

The volume and value of primary and secondary transactions of high-rise residential properties in the Klang Valley have continued to improve, said Savills Malaysia associate director of research and consultancy Fong Kean Hwa in presenting the The Edge | Savills Klang Valley High-Rise Residential Property Monitor for 4Q2022.

“The total transaction volume and value for non-landed residential properties across Greater KL have increased to 17,005 units in 1Q to 3Q2022, from 12,763 units in 1Q to 3Q2021, supported by the improving market sentiment and pent-up demand, especially for properties in the affordable price range,” he says.

There was almost an equal number of transactions in the first three quarters of last year (17,005 units) as there was in the same period in 2021 (18,073 units) in Greater KL, Fong highlights. “The transaction value of RM9.97 billion in the first to third quarters of last year has surpassed 2021’s performance of RM9.76 billion. This growth is mainly concentrated in the Kuala Lumpur area.”

Fong says that the average transaction price of non-landed residential properties has improved throughout Greater KL “as investor confidence returned to the prime markets”.

In terms of supply, he says that the pace of construction has reached pre-pandemic levels and is likely to surpass the 2019 threshold.

Fong: The total transaction volume and value for non-landed residential properties across Greater KL have increased … supported by the improving market sentiment and pent-up demand, especially for properties in the affordable price range (Photo by Savills)

“The high-end, high-rise residential market witnessed a continued streak of completions of upcoming projects, mainly due to the normalcy of on-site activities and improvement in the labour market.”

In the first three quarters of last year, 46,147 new units were added to the existing supply in Greater KL. Fong adds that the total yearly supply for 2022 is likely to exceed the pre-pandemic threshold of 49,897 units in 2019.

Meanwhile, the housing market remains challenging with inflation and rising interest rates, says Fong. “High inflation increases the burden of daily life for most people. While Bank Negara Malaysia is expected to raise the OPR (overnight policy rate) further in 2023 to ease rising inflation, this does not help as further OPR increases will continue to affect the borrowing capacity of existing and new homebuyers. The current OPR is 2.75%, with the last 25-basis-point hike in November 2022.”

The continued price hike in building materials caused by factors such as geopolitical instability and the supply chain disruption has affected the primary market, and will likely have a spillover effect on the secondary market, Fong adds.

“This will likely demotivate potential buyers to an extent in the future, adding to the current challenges. In such a [difficult] market, developers face the dual challenge of controlling project costs while attracting more sales. As a result, the number of new launches has shrunk. Developers are seen taking a wait-and-see approach, partially due to market uncertainties and delays in receiving approvals from authorities.”

In the short term, Fong expects the property market to remain sideways. “While the newly established government is likely to boost investor confidence and stir economic activities to an extent, limited provisions for the property sector in Budget 2023, slower demand coupled with impending supply and continued pressure on living costs will continue to affect housing demand.”

KLCC market remains challenging

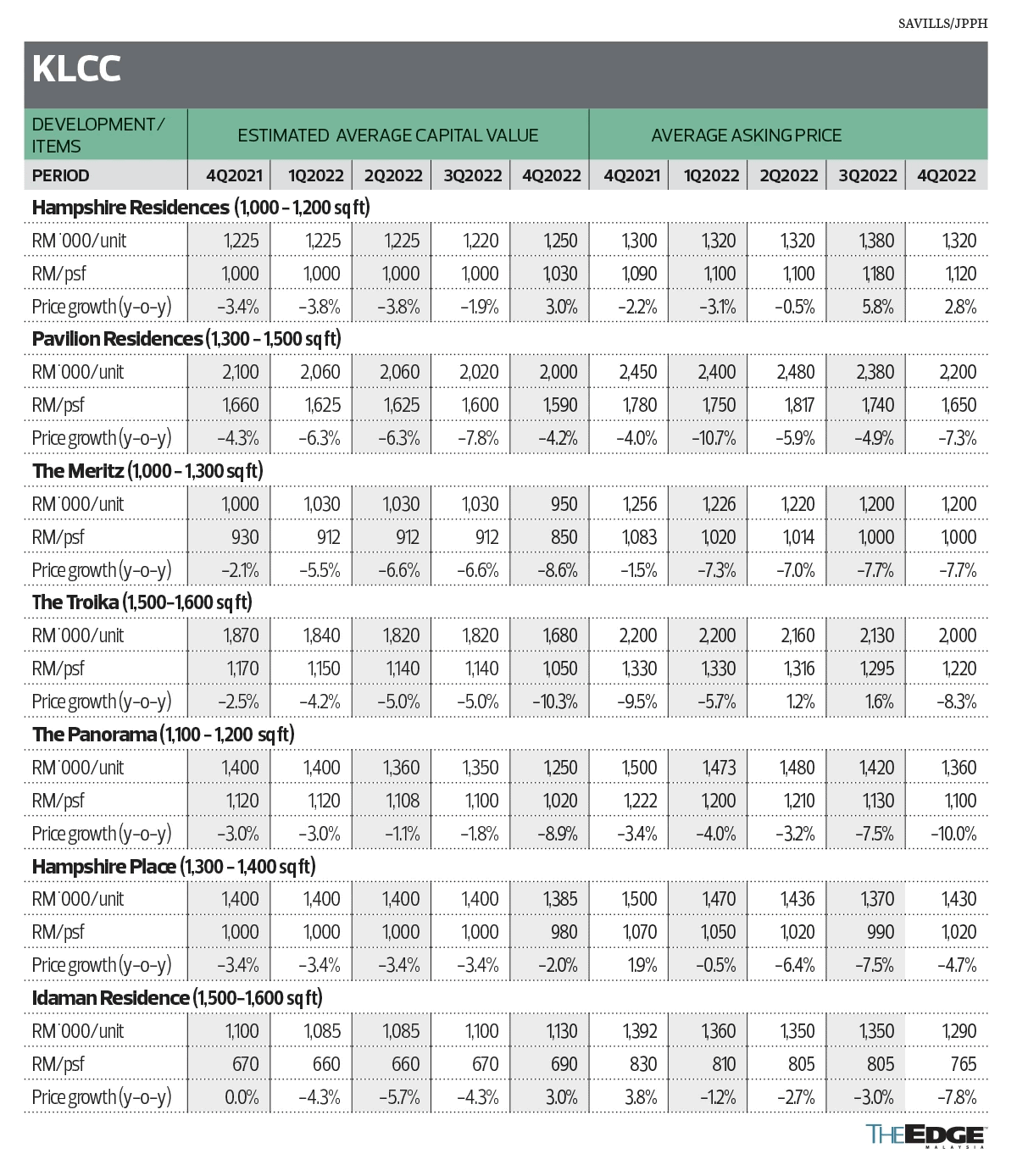

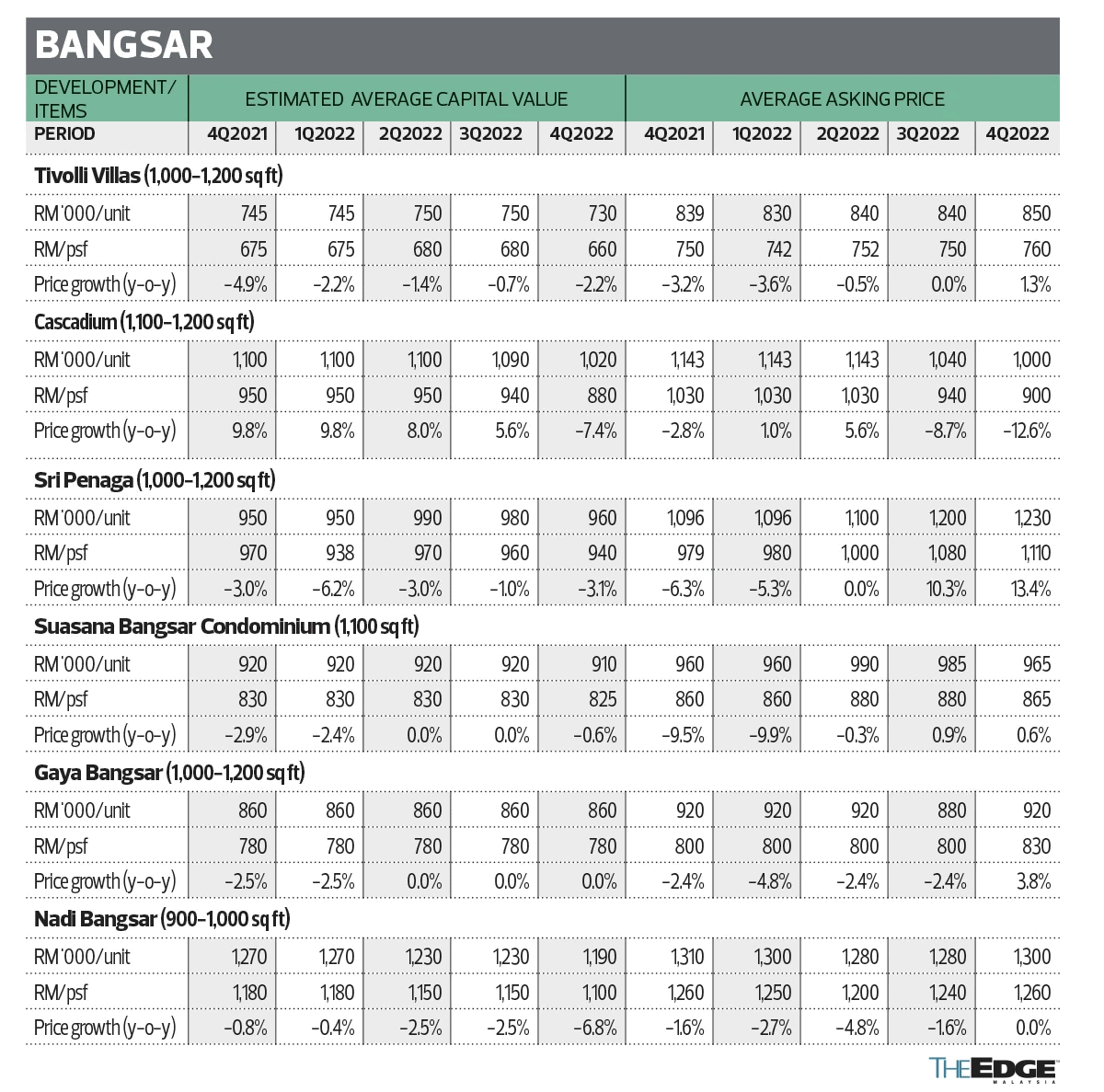

In the city’s prime submarkets of KLCC, Bangsar and Mont’Kiara, the average asking price continued to decline year on year (y-o-y) but the average capital value declined much faster, thus widening the price gap.

“This indicates a competitive property market and a buyers’ market, which is mainly caused by the larger gap in demand-supply. The market enables buyers to have a higher level of negotiation power, especially in the KLCC submarket, which is much affected by the absence of foreign buyers. Those eager to sell their properties would compromise at a lower price. Hence, the transaction values have declined more steeply,” he says.

KLCC was the worst hit during the pandemic and experienced the highest drop in average capital values compared to other submarkets.

“The main challenge for the city centre submarket is the large impending supply and product mismatch with the high supply of studios or units suitable for short-term stays, as these products mainly cater for investors instead of owner-occupiers.”

Fong reveals that during the quarter under review, the average capital value of two-bedroom units sampled in KLCC declined by 2.9% quarter on quarter (q-o-q) and 4.5% y-o-y to RM1,030 psf in 4Q2022. The asking price for similar two-bedroom-type units also continued to adjust sharply by -3.3% q-o-q and -6.3% y-o-y, due to the competitive market in the city centre region. The price gap between the average capital value and the asking price in KLCC remained broadly stable at 9%.

“Foreign investors are the primary buyers in the city centre market. Although the inflow of foreigners has resumed, investment activity, especially in the city centre region, has yet to pick up to pre-pandemic levels. Also, the sizeable impending supply situation may continue to affect capital value and rent,” says Fong.

During the period under review, Exsim Group launched Hugoz Suites in KLCC. This project mainly offers 664 units ranging from 323 to 646 sq ft and is expected to be completed by 2026.

Bangsar and Mont’Kiara on road to recovery

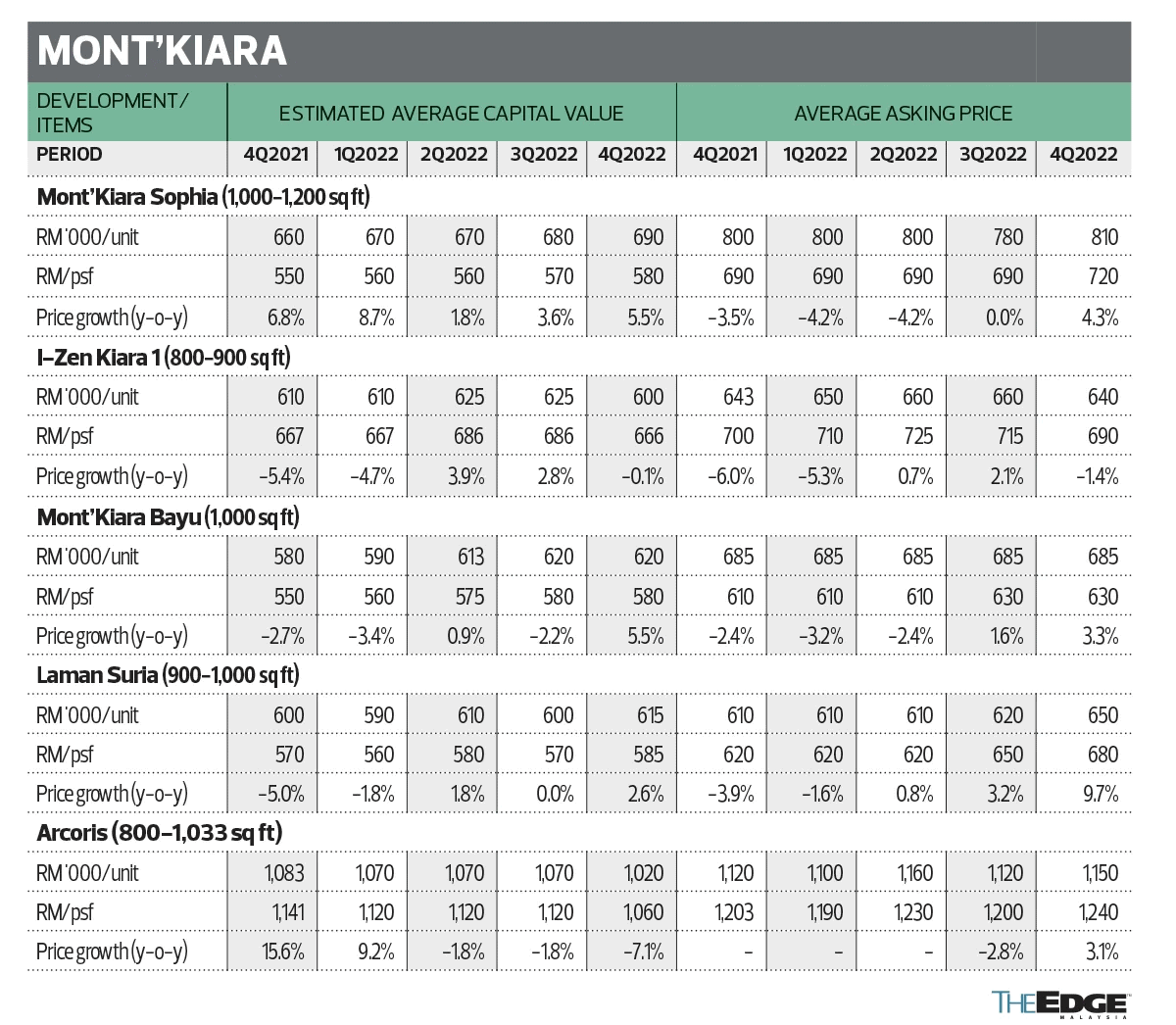

As for the city periphery’s prime submarkets of Bangsar and Mont’Kiara, Fong says they are on the road to recovery.

“Residential supply in Bangsar and Mont’Kiara primarily caters to individuals or families for own occupancy and long-term tenants or expats with families. This is in contrast with the city centre submarket, which predominantly caters to foreign investors, short-term business visitors and tourists.

“After the reopening of international borders, market activity for long-term tenancies picked up and the mature neighbourhoods in the city periphery’s submarkets of Bangsar and Mont’Kiara witnessed recovery.”

Nevertheless, Bangsar still registered a drop in the average capital value of two-bedroom units sampled by 2.9% q-o-q and 3.7% y-o-y to RM864 psf during the review period. However, the average asking price improved marginally by 0.6% q-o-q and 0.8% y-o-y and remained relatively stable at RM954 psf. The price gap between the capital value and the asking price widened to about 10% during the quarter due to a bigger decline in capital values.

“Similar to other prime markets in the city, the Bangsar market remained soft amid large supply and continuous inflow of new projects. In such a challenging environment, buyers hold more negotiation power,” says Fong.

There were no new launches in Bangsar during the fourth quarter.

In contrast, Mont’Kiara was the least affected among the other city submarkets, with a slight drop in the average capital value of the two-bedroom units sampled of -1.6% q-o-q and -0.2% y-o-y to RM694 psf during the quarter under review. The average asking price also improved marginally by 1.9% q-o-q and 3.6% y-o-y at RM792 psf. This indicates a return of investor confidence, says Fong, and a wider price gap between the capital value and the asking price at 14%.

A new project launched in Mont’Kiara during the quarter was Bon Kiara by Bon Estates Sdn Bhd. The condominium project comprises 410 units with built-ups ranging from 2,081 to 6,226 sq ft, with sale prices starting at RM1.2 million.

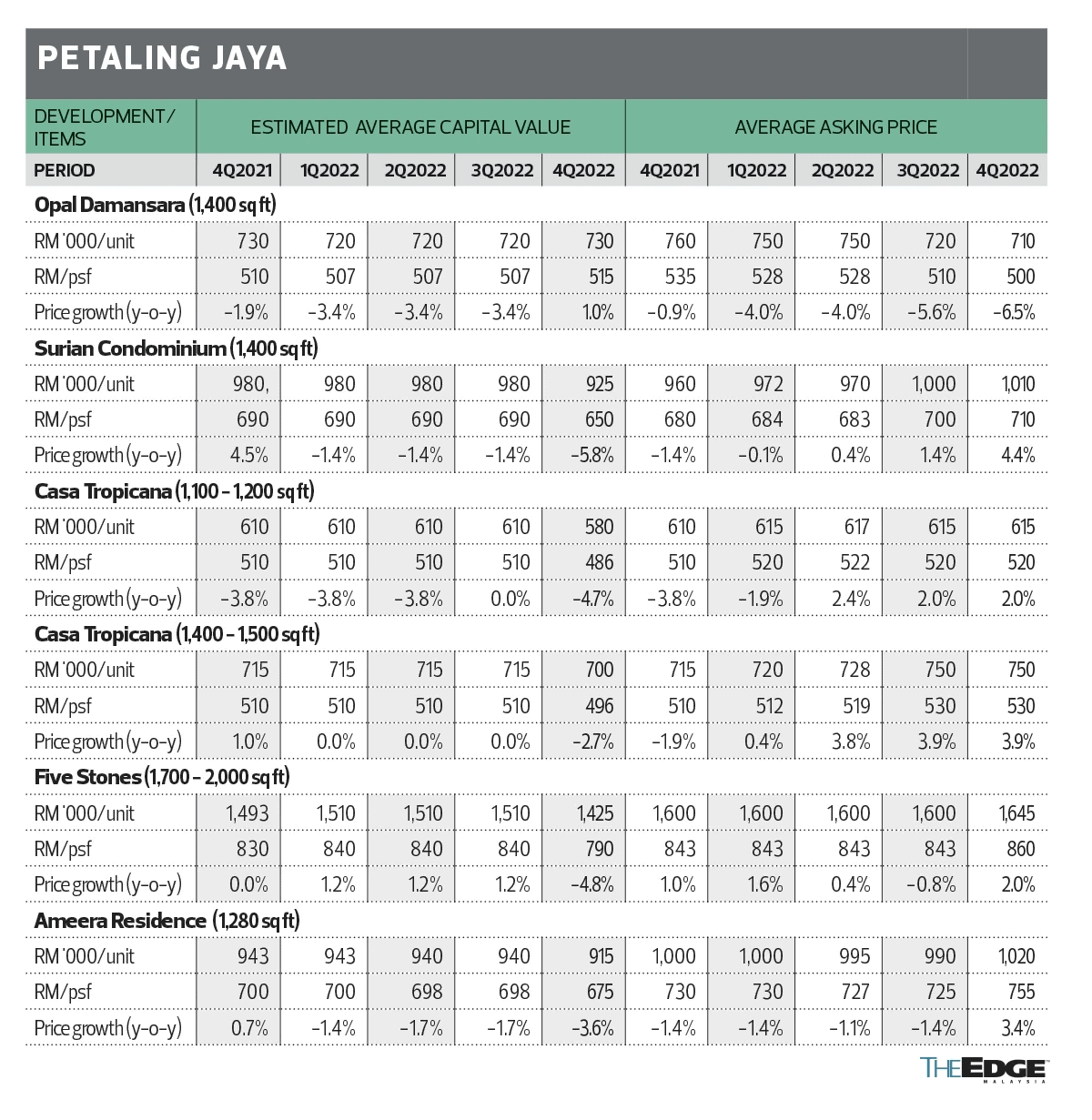

Marginal change in Selangor’s suburban submarkets

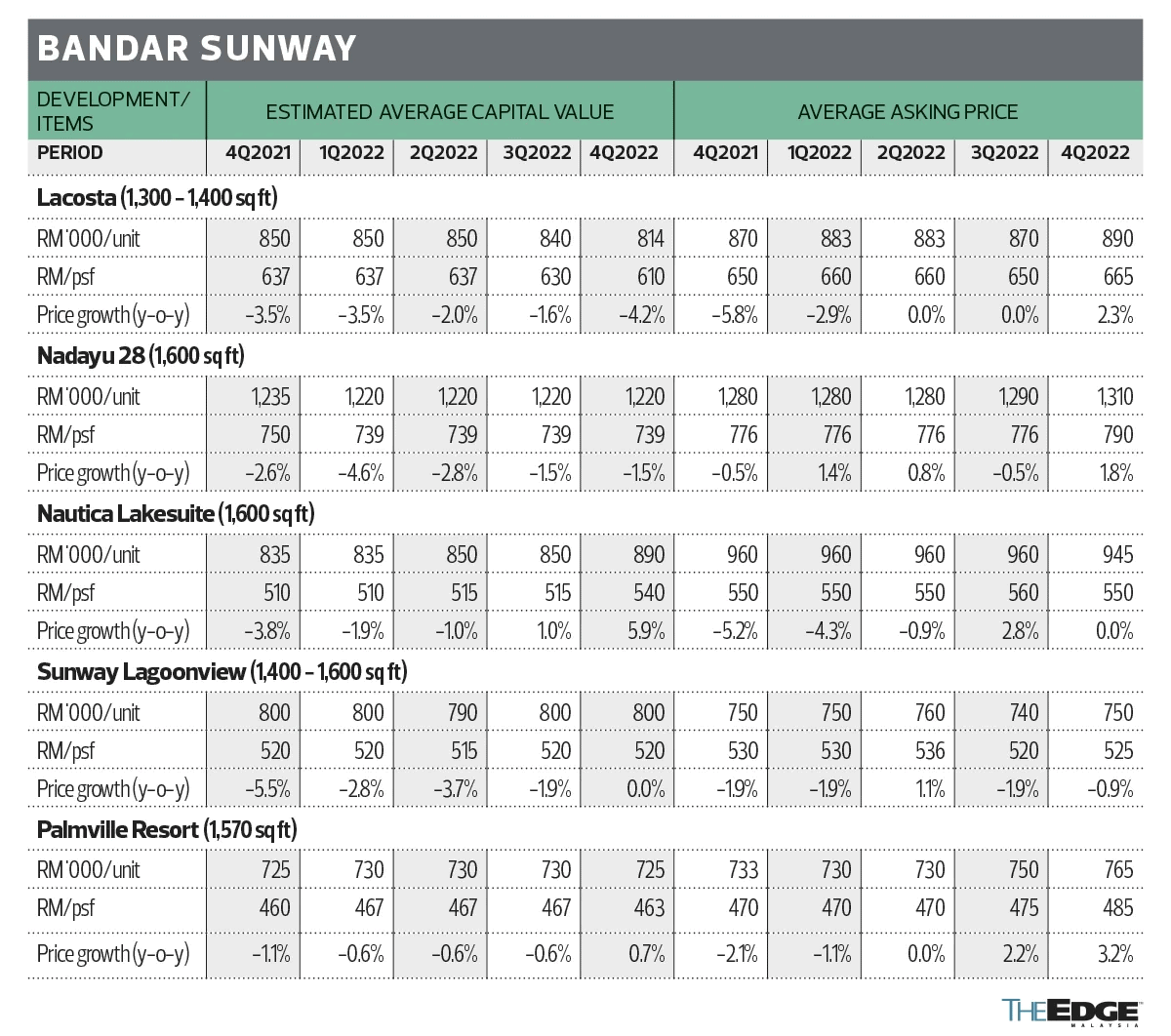

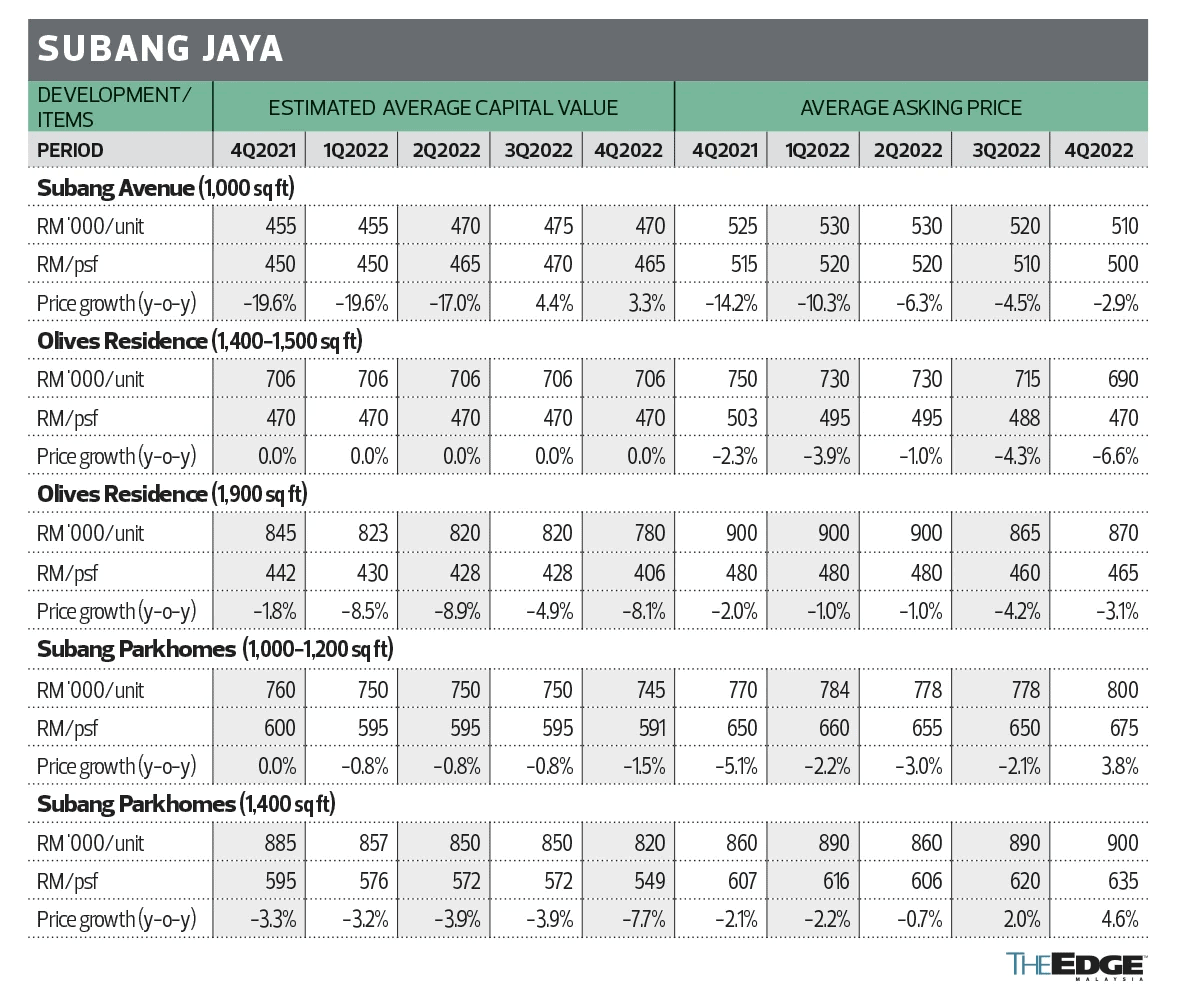

In contrast to the city’s prime submarkets, the suburban prime submarkets of Bandar Sunway, Subang Jaya and Petaling Jaya saw capital values and asking prices remain broadly stable or with marginal change.

“The price gap in the suburban submarkets remained lower than the city submarkets, indicating a healthy demand.

“The introduction and completion of new infrastructure projects have been the backbone for development in suburban markets. Additionally, the incoming supply in the suburbs is growing organically and hand-in-hand with the demand. As a result, the suburban submarkets are much more stable than the city submarkets.”

In Bandar Sunway, the average capital value of the sampled three-bedroom units remained generally stable with a negligible change of -0.2% y-o-y at RM574 psf during the review quarter. There was no change recorded on a q-o-q basis. The average asking price witnessed a negligible increase of 1.1% and 1.3%, q-o-q and y-o-y respectively, at RM603 psf. The price gap between the asking price and the average capital value remained rather low at 5%, which indicates healthy demand-supply dynamics.

There were no new launches in Bandar Sunway during the review quarter.

In Subang Jaya, the average capital value of the sampled three-bedroom units continued to be subdued, falling 3% y-o-y and 2.1% q-o-q at RM496 psf. The average asking price, on the other hand, improved by 0.6% q-o-q but was lower by 0.4% y-o-y at RM549 psf. As asking prices improved but capital values declined, the price gap between the asking price and the average capital value increased to 11%.

A new project that was launched in Subang Jaya during the review period was The Serenade at The Glades by Sime Darby Property Bhd. The low-rise, low-density condominium has 122 units ranging in size from 1,335 to 2,465 sq ft and is expected to be completed by 2025.

Another project launched in 4Q2022 was Teja, also by Sime Darby Property. It offers 271 units ranging from 800 to 1,150 sq ft and is expected to be completed in 2026.

In Petaling Jaya, the average capital value of the three-bedroom units sampled there moderated by -4.8% q-o-q and y-o-y to RM600 psf. Similar to other suburban markets, the asking price increased marginally by 1.2% q-o-q and 1.7% y-o-y at RM646 psf. Due to the opposite trends in capital values and asking prices, the price gap widened to 8%.

During the quarter, The Atera (Phase 1) by Paramount Property Development Sdn Bhd, which had its soft launch in August last year, was officially launched. The project offers 756 units with sizes ranging from 770 to 1,419 sq ft.

While the suburban submarkets in Selangor saw a mixed performance in terms of capital values, asking prices in most of the suburban conurbations have improved marginally, indicating a return in investor confidence, notes Fong.